Initial Outlay Formula

Divide the cash outlay which is assumed to occur entirely at the beginning of the project by the amount of net cash inflow generated by the project per year which is assumed to be the same in every year. The formula for the payback method is simplistic.

Formula For Calculating Net Present Value Npv In Excel

Next the second column Cumulative Cash Flows tracks the net gainloss to date by adding the.

. Internal Rate of Return - IRR. Payback period is the time in which the initial outlay of an investment is expected to be recovered through the cash inflows generated by the investment. As mentioned above Payback Period is nothing but the number of years it takes to recover the initial cash outlay invested in a particular project.

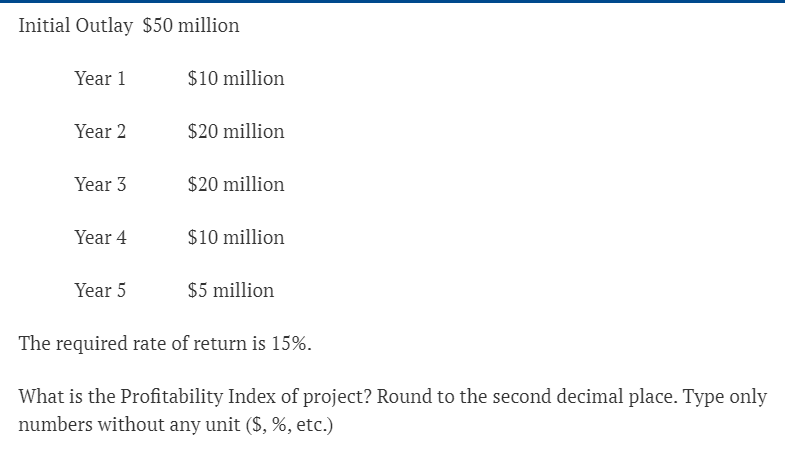

For programs that follow the federal fiscal year October 1 to September 30 the rates are still applied using the LEAs fiscal year as the basis. Supposing you have the initial outlay in B2 a series of future cash flows in B3B7 and the required return rate in F1. The formula for a project that has an initial capital outlay and three cash flows follows.

Go-karting drivers progress to the regional single-seater events and then F3 and F2 and eventually F1 if they are good enough. The first stage of working towards being an F1 or any professional driver is go-karting. Each period of the projects projected net after-tax cash flows initial investment outlay and the appropriate discount rate is really important in calculating the net present value.

Proceeds from the sale of a portfolio company are 100m from a 10m initial equity investment the MoM would be 100x. The payback period shall be the corresponding period when cumulative cash flows are equal to the initial cash outlay. Internal rate of return IRR is a method of calculating an investments rate of returnThe term internal refers to the fact that the calculation excludes external factors such as the risk-free rate inflation the cost of capital or financial risk.

The formula looks complicated to take acc ount for all of the future cash flows and discount them by the interest rate r. The method may be applied either ex-post or ex-anteApplied ex-ante the IRR is an estimate of a future annual rate of return. Internal rate of return is a discount.

To determine the IRR of a given project you first need to estimate the initial outlay the cost of. For example if the total cash inflows ie. Cash Flows tracks the cash flows of each year for instance Year 0 reflects the 10mm outlay whereas the others account for the 4mm inflow of cash flows.

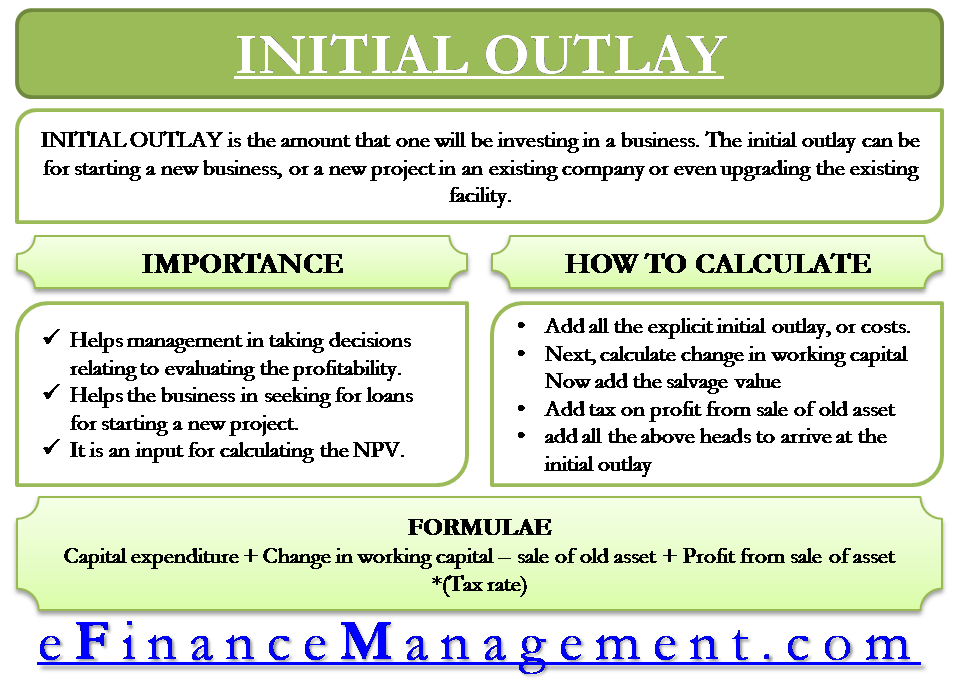

It equals capital expenditures plus working capital requirement plus after-tax proceeds from assets disposed off. Since cash flow estimates are quite accurate for periods in the near future and relatively inaccurate for periods in distant future due to economic and. For example the approved rate for the initial fiscal year would be used for October 1 through June 30 and then the new approved rate would be used for the July 1 through September 30 time period.

It is also called initial investment outlay or simply initial outlay. To find NPV use one of the following formulas. It is one of the simplest investment appraisal techniques.

However unlike most other sports parents initial capital outlay is significant from a very young age. If an assets useful life expires immediately after it pays back the initial. Initial investment is is the amount required to start a business or a project.

Please notice that the first value argument is the cash flow in period 1 B3 the initial cost B2 is not included. Payback Period Formula Total initial capital investment Expected annual after-tax cash inflow 2000000221000 9 Years. NPVF1 B3B7 B2.

Payback Period Initial Investment Cash Flow Per Year. Internal Rate of Return IRR is a metric used in capital budgeting to estimate the profitability of potential investments. Payback Period Formula.

Accordingly Payback Period Full Years Until Recovery Unrecovered Cost at the Beginning of the Last YearCash Flow During the Last Year. In case the sum does not match then the period in which it lies should be identified. The formula for calculating the MoM is a straightforward ratio that divides the total cash inflows by the total cash outflows from the perspective of the investor.

How To Calculate Initial Investment Operating Cash Flow Terminal Cash Flow For Capital Budgeting Youtube

Initial Outlay Meaning Importance And Calculation

How To Calculate Initial Investment Operating Cash Flow Terminal Cash Flow For Capital Budgeting Youtube

Solved Initial Outlay 50 Million Year 1 10 Million Year 2 Chegg Com

Comments

Post a Comment